Helping Individuals Grow and Excel Since 1969

Thorncroft strives to develop the physical and emotional well-being of all who come to the farm.

In an environment of love and respect, Thorncroft helps individuals grow and excel in ways never believed possible.

Thorncroft is committed to helping individuals of all abilities heal, grow and develop through the use of 24 instructors, over 30 horses, 2 indoor arenas on 70 acres of open space.

Dear Friends,

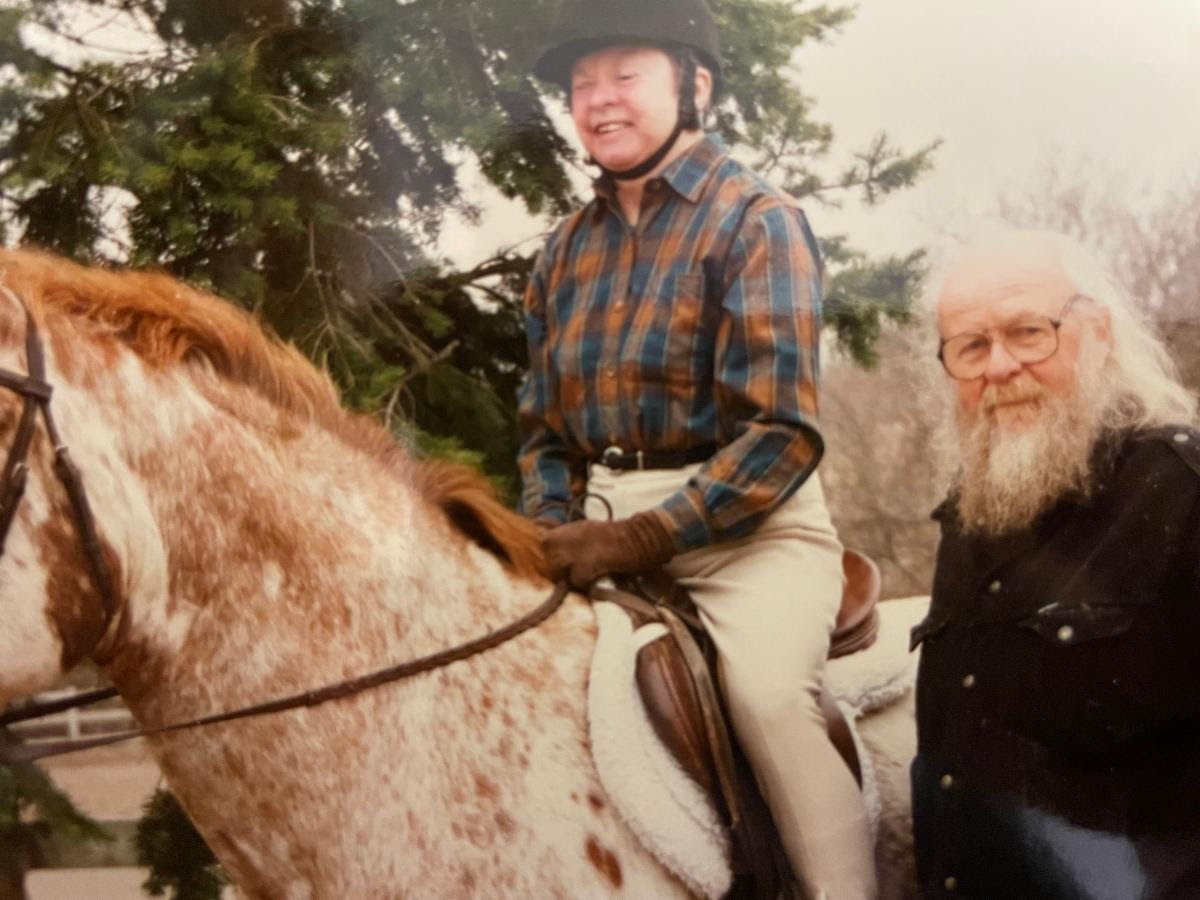

The community is invited to an open house gathering to celebrate the life of Saunders Dixon (March 5, 1928-February 11, 2024) at Thorncroft on

Sunday, April 21 from 9:30 a.m. – 12:30 p.m. All are welcome.

In peace,

Your friends and family at Thorncroft